reit dividend tax malaysia

REIT dividend will be taxed in their tax computation. Meanwhile on Malaysian REITs still commanding attractive yields Yap says the high-yielding and Covid-19-resilient office REITS offer better interim gains via dividend yield.

How Are Individual Reit Holders Taxed

A REIT needs to pay tax on any taxable income earned during the year at a rate of 24 unless it distributes at.

. In Malaysia the companies are levied on incomes and the tax rate is settled at 25. According to this regime the corporate income tax imposed on a. Continue reading Top 10 REITs in Malaysia.

Listed REITs in Malaysia are exempted from annual tax assessment if they distribute 90 of the years total income to unitholders. REIT dividend will be taxed in their tax computation. 19 rows Monthly Dividends Portfolios.

Hektar is the first retail focused reit in Malaysia. Employment income includes salary. The reduced withholding tax of 10 on individual and non-corporate investors is only available.

As long as REITs in Malaysia distributes at least 90 of its current year taxable income the REIT will not be levied the 25 income tax. Is REIT Dividend Taxable In Malaysia. Gearing is the highest as well at 442.

Prior to the announcement under the tax laws a property trust fund essentially an unit trust with income. 3 Years Continuous Growing. How Does Reits Work In Malaysia.

Today there are a total of 17 REITs in Malaysia each of them with different properties including malls offices hotels factories etc. Is REIT Dividend Taxable In Malaysia. Trusts or Property Trusts REITPTF in Malaysia.

No withholding tax tax-resident company investors. As a comparison neighbouring. One huge tax benefit of a REIT is that most income earned by it is exempted from income tax.

An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made. As for the technical fees royalties and other earnings we remind that the tax rate is 10. Real estate investment trust or property trust fund public ruling no.

With this tax system most Malaysian REITs if not. Dividend income forms part. REIT dividend will be taxed in their tax.

This allows the REIT to distribute its income on a gross basis. REITs are a type of security that invests in real estate and are often listed publicly on stock exchanges. General company tax of 25 is applicable.

REITs in Malaysia do not have to pay income tax if they distribute at least 90 of their current-year. Real estate investment trusts REITs are a unique form of investment designed to make money for you through the property industry. The reduced withholding tax of 10.

The first real estate investment. General company tax of 25 is applicable. REITs in Malaysia and around the world benefit from favorable tax treatment and typically give larger dividend yields than other corporations.

Even if a REIT is exempt from tax by distributing at least 90 of its total income during the year the distribution to unit holders will be. In a nutshell thats how REITs work. Starting for the year 2009 tax for REIT dividend is as follows.

It has strong cornerstone investor which is Frasers Centrepoint Trust listed in. On the other hand tax exempt income received by REITs and subsequently distributed to unit holders continue to be tax exempt in the hands of these unit holders. REITs unit holders are taxed in the year of assessment the distribution is received not the financial year of the REITs.

One huge tax benefit of a REIT is that most income earned by it is exempted from income tax. REITs in Malaysia and around the world receive special tax considerations and. It may also earn income from fixed deposits or selling its real estate investments.

A REIT in Malaysia operates by pooling the.

Reits Listed On Bursa Malaysia As At March 2016 Download Scientific Diagram

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

Top 10 M Reits By Market Cap Rm B Source Midf 2016 Download Scientific Diagram

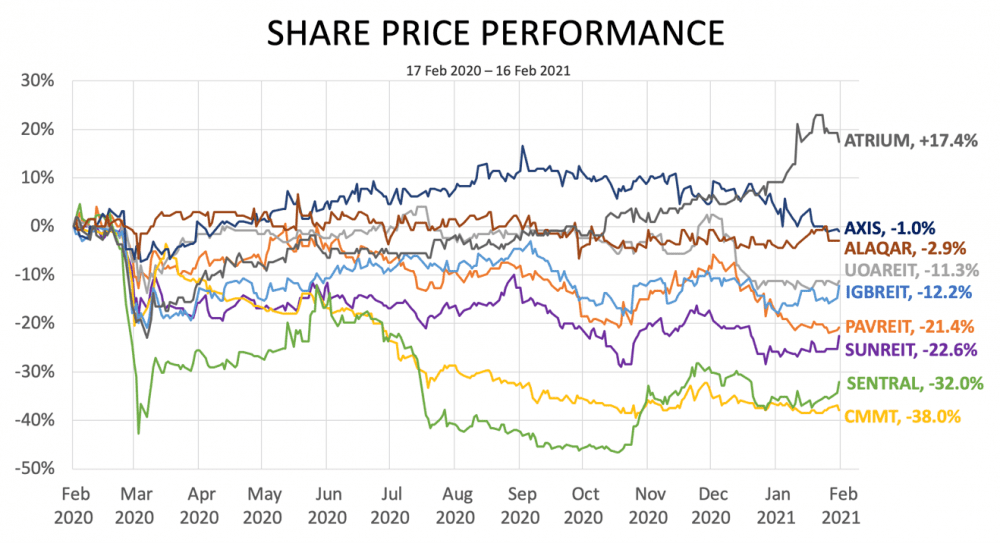

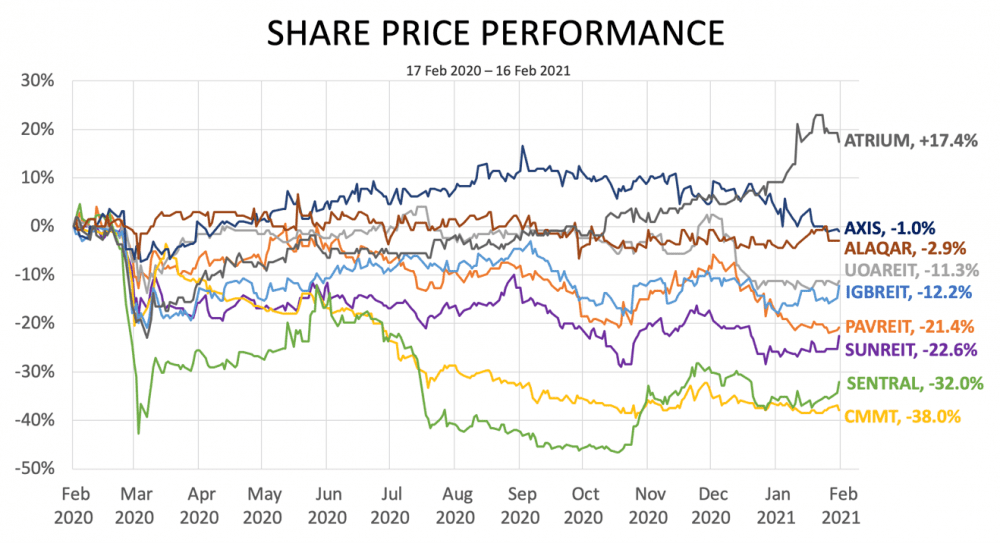

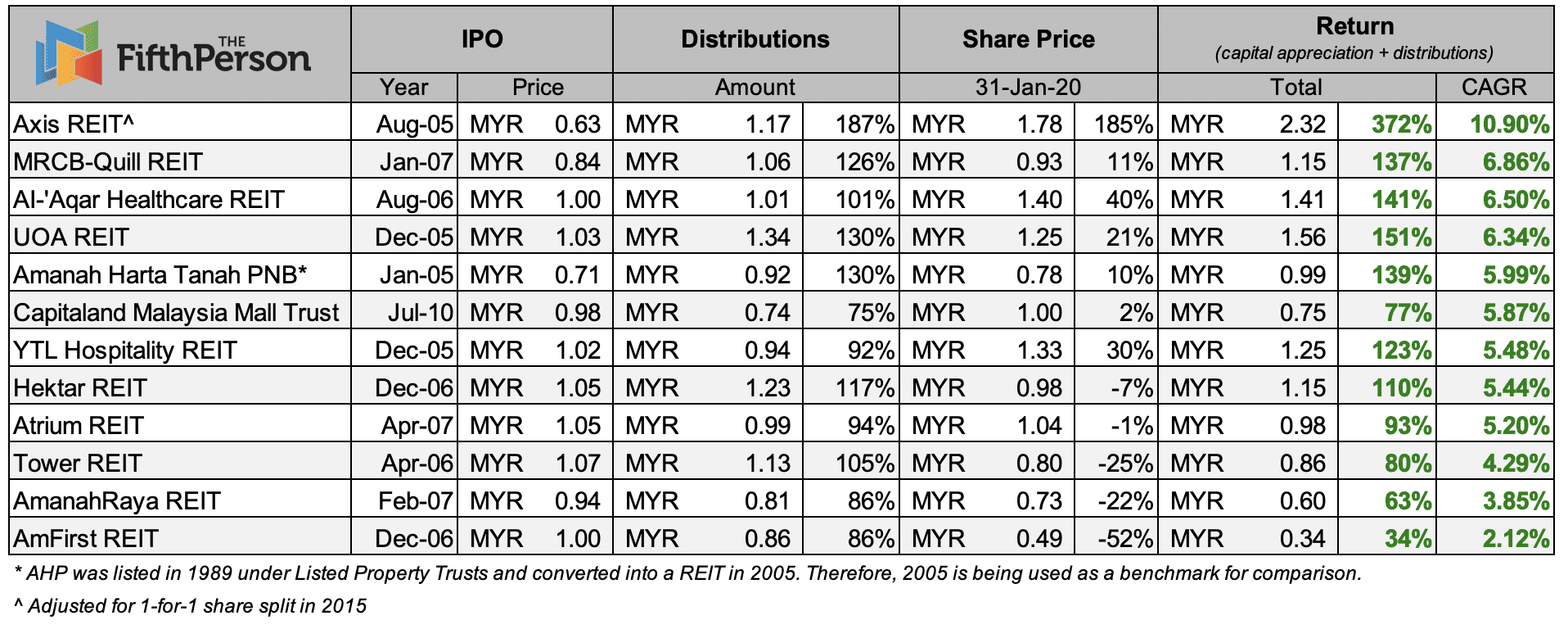

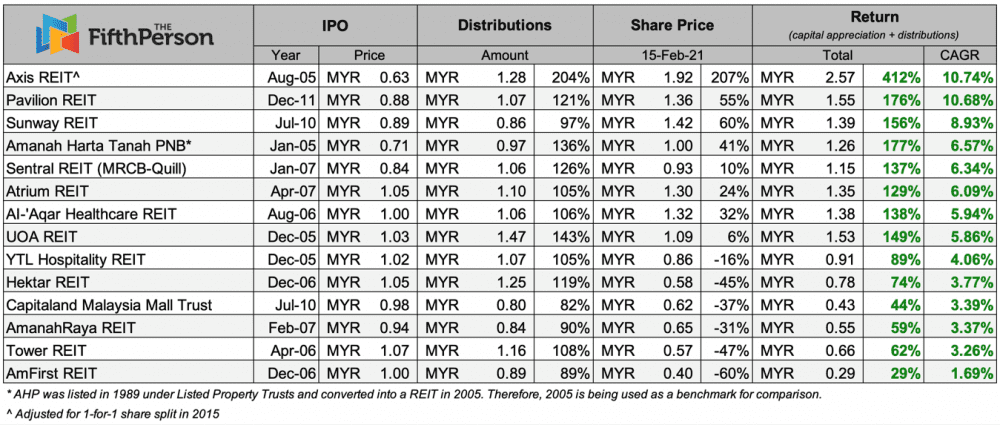

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

Real Estate Or Reits Which Is More Beneficial For Investment Purposes

The Complete Guide To Reits In Malaysia Your Real Estate Partner

Multi Management Future Solutions Malaysia Tax On Reit Investment Malaysia Starting For The Year 2009 Tax For Reit Dividend Is As Follows Also Grab The Opportunity Of Free Analysis Report

Nav And Dpu Of Ireits In Malaysia Download Scientific Diagram

How Are Individual Reit Holders Taxed Thannees Articles

Top 5 Malaysian Reits That Made Money If You Invested From Their Ipos

A Complete Guide To Reits Malaysia Real Estate Investment Trusts Youtube

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

The Ultimate Guide To Investing In Reits In Malaysia The World Bizweek

Etf Portfolios Investing Real Estate Investment Trust Trading

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021