estate tax return due date canada

Tax Deadline 2023 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips The Best Online Tax. 2- File the necessary.

2022 Texas Franchise Tax Report Information and Instructions.

. Apr 30 2022 May 2 2022 since April 30 is a Saturday. For a T3 return your filing due date depends on the trusts tax year-end. On the final return report all of the deceaseds income from January 1 of the year of death up to and including the date of death.

For most people the 2021 return has to be filed on or before April 30 2022 and payment is due April 30 2022. 9000 4000 5000. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

What Is The Child Tax Credit Tax Policy Center New Irs Guidance Expands Tax Deadlines Deferred To July 15 Tax. If the death occurred between january 1 and october 31 inclusive the due date for the final return is april 30 of the following year. Deadline to file your taxes.

A return must be filed for the year of death of the deceased person. Use e-Signature Secure Your Files. This is known as a persons terminal return.

Generally the estate tax return is due nine months after the date of death. Any taxes owing from this tax return are taken from the estate before it can be settled dispersed. This varies by state - in New York for example if value is over 593 million a return must be filed.

If Rita chooses Dec. The types of taxes a deceased taxpayers estate can owe. 31 as the estate yearend and files.

15 the due date for the final. Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips Enter the wind-up date on. For the most part the usual income tax rules apply to prepare the terminal.

If you applied for an estate certificate before January 1 2020 the tax rates are. Estate tax return due date canada Sunday October 23 2022 Edit. Report income earned after the date of death on a T3 Trust.

1- Notify the Canada Revenue Agency of the death. For previous year returns that are already due but were not filed by the deceased the due dates for filing those returns as well as payment of any related taxes owing remain the same. From the readjusted balance subtract all capital gains deductions claimed to date.

The due date of this return depends on the date the person died. File your return early or. In one calendar year you have to file a T3 return the related T3 slips NR4 slips and T3 and NR4 summaries no later.

365 Bloor Street East Toronto Ontario M4W 3L4 416-383-2300. Deadline to contribute to an RRSP a PRPP or an SPP. Filing dates for 2021 taxes.

Estate tax returns are due 9 months after the date of death with a 6 month. The final return can be E-filed or. The first checks and direct deposits from 3 billion in excess tax revenue will head back to Massachusetts taxpayers starting Tuesday when the calendar officially changes to.

Postmedia Network Inc. You can use 5000 to reduce the deceaseds other income for 2021. To calculate the amount of Estate Administration Tax the estate owes use the tax calculator.

First there are taxes on income or on. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. Before distributing assets they must complete the following steps to obtain a clearance certificate.

The balance-due date for the 2017 tax year is April 30 2018 and one year after that date is April 30 2019. The other optional Returns such as Return for a Partner or Proprietor and the Return of Income from a Graduated Rate Estate are due on the same date as the final return. Estate tax return due date canada Wednesday October 19 2022 Edit.

The Canada Revenue Agency CRA recently. Filing due dates for the 2021 tax return. The other optional Returns such as Return for a Partner or Proprietor and the Return of Income from a Graduated Rate Estate are due on the same date as the final return.

So April 30 2019 is your deadline to file a notice of objection for your 2017.

Earned Income Credit H R Block

Filing Taxes On H1b Visa The Ultimate Guide

What Happens If You File Taxes Late Northwestern Mutual

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

How To Answer The Virtual Currency Question On Your Tax Return

Canada Revenue Agency Wikipedia

Which Form Does An Estate Executor Need To File H R Block

Irs Tax Return Forms And Schedule For Tax Year 2022

A Guide To Estate Taxes Mass Gov

How To File A Late Tax Return In Canada

How To Report Foreign Earned Income On Your Us Tax Return

Video Guide To A Fiduciary Income Tax Return Turbotax Tax Tips Videos

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Basic Tax Reporting For Decedents And Estates The Cpa Journal

Emancipation Day Delays Tax Return Filing Due Date Wolters Kluwer

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

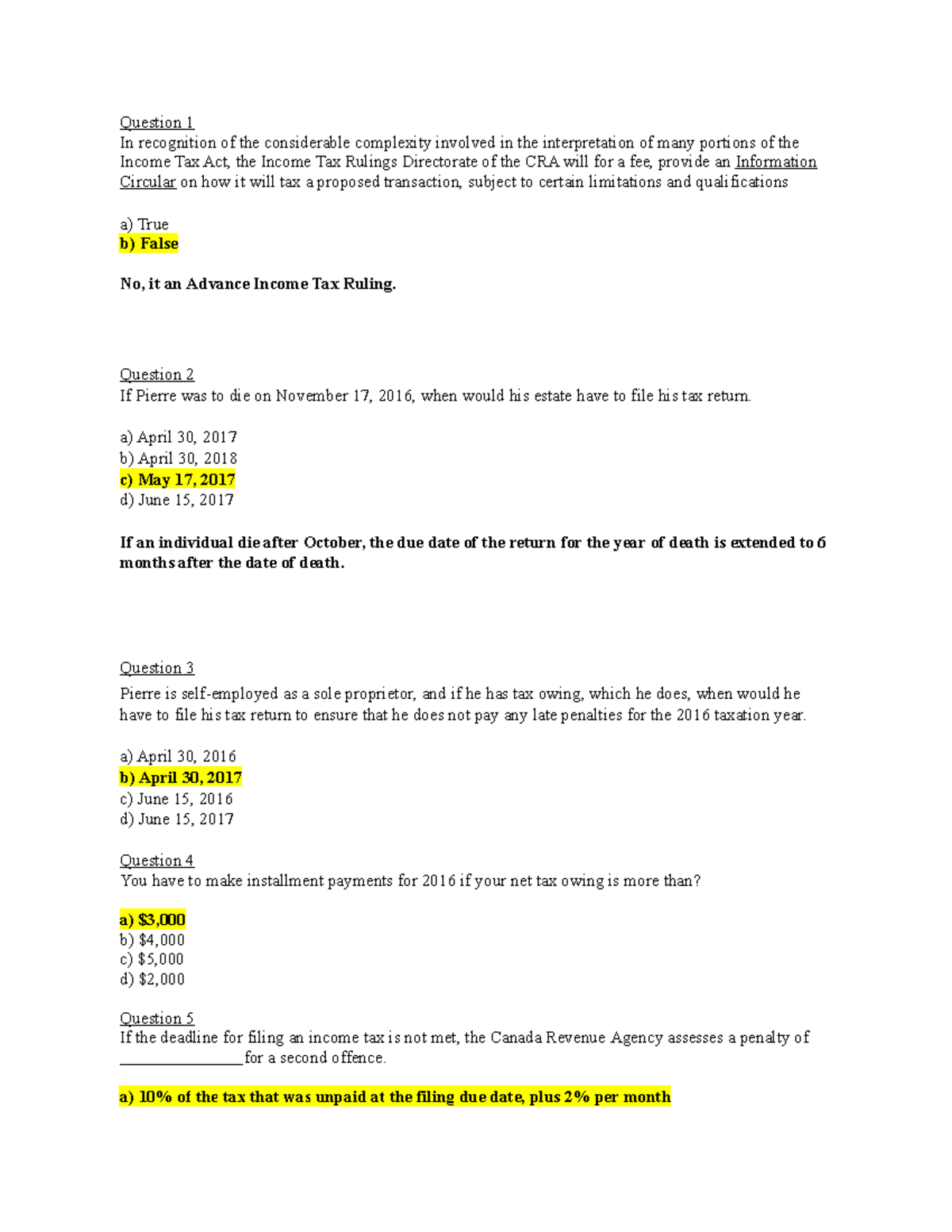

Acct226 Mcq And Answer Chapter 10 6 Question 1 In Recognition Of The Considerable Complexity Studocu

2021 Taxes 8 Things To Know Now Charles Schwab

Applying For A U S Tax Identification Number Itin From Canada Us Canadian Cross Border Tax Service Cross Border Financial Professional Corporation